Product Page: https://www.xlstat.com/en/solutions/xlrisk

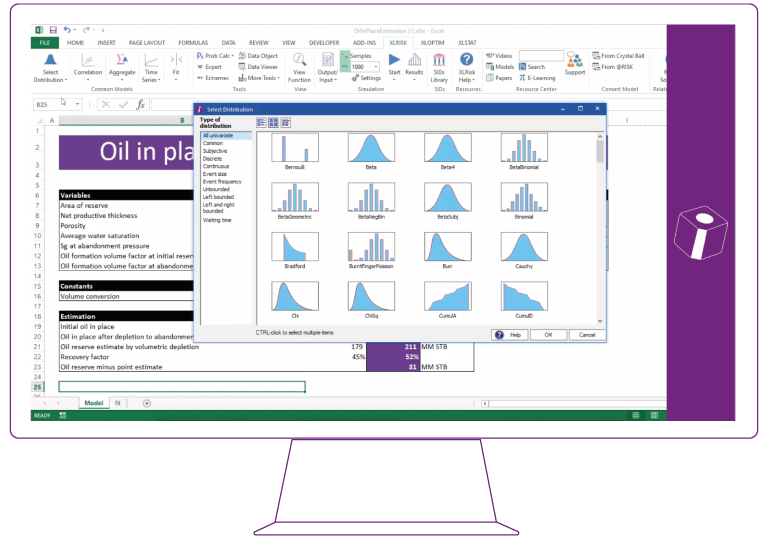

XLRISK, a powerful Monte Carlo simulation Excel add-in.

XLRISK, developed by Vose Software, introduces many technical Monte Carlo method features that make risk models easier to build, easier to audit and test, and more precisely match the problems you face.

An XLRISK user replaces uncertain values within their Excel model with special XLRISK quantitative probability distribution functions that describe the uncertainty about those values. XLRISK then uses Monte Carlo simulation to automatically generate thousands of possible scenarios.

At the end of the Monte Carlo simulation run, which typically takes a few seconds, the results are displayed in a variety of graphical and statistical formats that will tell you things like:

– What is the probability we will come under budget?

– Which investment gives me the greatest return for a given level of risk?

– How much capital do we need to be 95% sure of having enough for the project?

– Which component configuration gives me the greatest chance of achieving a certain operation time before a failure occurs?

Features Overview

– Simulation: Monte Carlo simulation, Multiple simulation runs for scenarios, Unrestricted speed, and more.

– Reporting: View simulation results statistics in spreadsheet, Export results to PowerPoint, Word, PDF or Excel, Sensitivity and scenario analysis, and more.

– Features by number: 136 distributions, 14 correlation models, 34 time series functions.

– Fitting: Fitting distributions to data (95), fitting correlations structures to data (11), fitting time series to data, and more.

– Ease-of-use features: One-click function view, @RISK and Crystal Ball converters, full help file and example models, functions descriptions in spreadsheet.

– Technical tools: Data Viewer, assumption and result sharing between models, extreme value tools, probability calculations, Markov chain tools, and more.

– Industry tools: Financial tools, insurance tools, PK/PD pharma tools.